When it comes to buying a home or refinancing an existing mortgage, one of the most important decisions you’ll make is how to secure your loan. Many borrowers automatically go straight to their bank — it’s familiar, seemingly convenient, and often feels like the default option. But there’s another route worth considering: working with a…

Read MoreSeveral New Zealand banks have announced an increase in the loan-to-value ratio (LVR) for investment property lending taking it from 65% to 70%. This change creates an opportunity for investors to have their mortgage lending reviewed. Erskine Owen Mortgage Broker, Wendy Ryan-Kidd says this is a positive move for investors allowing them access to further…

Read More1. Our mortgage service has been helping hundreds of clients in Erskine Owen since 2011 Our mortgage brokering service offers the most comprehensive financial solution to our clients. Every year we cater to many clients for their mortgage needs so that they can meet their financial goals. We’re based in Auckland, but thanks to the technology, we’re able to help clients everywhere in New…

Read MoreOn Monday June 1st, a client approached Wendy Ryan-Kidd our in house Mortgage Broker, with a live deal to purchase an investment property with a value of $1.5 million. Their bank had approved only $500k of the $1.5 million they wanted to borrow, using their home to leverage equity. Wendy quickly assessed the situation and…

Read MoreApparently, the average interest rate, going back to Egyptian days, is below 5%, and that all the massive spikes in interest rates since 1900 have been due to massive population growth spikes. World population growth rates are slowing and are not expected to spike again, so if you believe that, you can safely forecast interest…

Read MoreThe Reserve Bank (RBNZ) recently proposed a 70% LVR restriction for investors in the Auckland property market. While it was tempting to jump straight out of the gates with a comment, we thought it would be more useful to wait for the RBNZ’s discussion document and provide a deeper analysis of their announcement. In this…

Read MoreOn Thursday 12 June, the Reserve Bank of New Zealand (RBNZ) lifted the Official Cash Rate (OCR) by 25 basis points to 3.25% as anticipated. What will be the impact of this increase? What will be the impact? Floating Mortgage Rate – Floating mortgage rates will increase, with lenders likely to follow ANZ’s lead and…

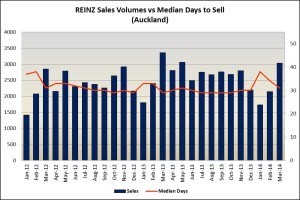

Read MoreIn March, the BNZ-REINZ residential market survey of real estate sales agents reveals an ease in market sentiment, as agents around the country reported most regions to be in equilibrium as buyers began to tentatively re-enter the market after adjusting to last year’s change in lending rules. However, anecdotal evidence from the survey is suggesting…

Read More

OCR Rate Cut – What Does it Mean for the Housing Market and Interest Rates

Our last interest rate article discussed the long term historical average rate sitting below 5%. We now have an OCR rate cut of 25 basis points, providing more evidence that rates will not be rising beyond 5% for the foreseeable future. What is perhaps more interesting is there is a widely held view that we…

Read More