1st Quarter Directors Market Commentary – How have the LVR speed limits impacted house prices?

In March, the BNZ-REINZ residential market survey of real estate sales agents reveals an ease in market sentiment, as agents around the country reported most regions to be in equilibrium as buyers began to tentatively re-enter the market after adjusting to last year’s change in lending rules. However, anecdotal evidence from the survey is suggesting property markets in Auckland and Christchurch to still be seller’s markets due to continuing strong demand and limited available stock. Overall, prices in the Auckland residential property market appear to be sticking to an upward trend, despite a slight turnaround during the months immediately following the introduction of the new LVR lending restriction.

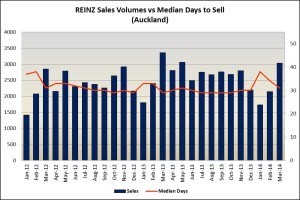

Key housing indicators has shown significant fluctuations between November and March, which is likely the result of seasonal behaviour as well as changes in the lending environment. However, it should be noted that the rebound in sales volume in the first quarter is less pronounced compared this year to the previous two years, which is in line with anecdotal evidence drawn from market participants with regards to dampened demand following the changes in the lending environment. However, although median days to sell had initially increased over the last few months as a result of a fall in demand due to the new lending environment, it has now fallen back to levels prior to the LVR restriction as buyers adjust to the changes in the market.

Looking at the trend in sales volumes in the last quarter of 2013, volumes in all three price segments show a clear downward trend during the quarter after the implementation of the LVR restriction. However, this drop-off was likely a result of seasonal effects as well as the LVR restriction rather than purely the workings of the restriction itself, as the credit restriction would have been unlikely to have a significant effect on buyers in the $1m+ range.

Other factors influencing the housing market include:

- The Reserve Bank has increased the OCR to 2.75% as expected. The general consensus amongst economists is to expect several more hikes to the OCR, with the rate being expected to increase up to 2% through 2014 and 2015. The interest rate increase has led to swift responses by major banks increasing their respective floating and short fixed term mortgage interest rates. Rising mortgage interest rates will likely to quickly increase debt burdens faced by New Zealand households due to most mortgages being either floating or on short fixed terms.

- The introduction of the new LVR rule had at first led to a two-tiered housing credit market in New Zealand, with borrowers under the 80% LVR threshold being able to secure more favourable rates compared to low equity borrowers, with banks also less willing to lend to low equity borrowers in order to meet their obligations under the new LVR restrictions. Initially, these dynamics had led to agents around the country reporting significantly lower open home attendance and fewer bids at auctions by first-home buyers. However, recent internal reviews by the major banks have shown their low equity lending since the introduction of the LVR speed limit to be well under the required threshold and has led to banks such as Westpac and BNZ ending their two-tiered rates in March 2014. These recent changes have led to first-home buyers slowly re-entering the market.

- After a slight improvement in January due to slowing house price inflation, Auckland home loan affordability worsened in February with the Roost Home Loan Affordability in February increasing to 80.1% of a single median income to service the mortgage of a median priced house, up from 77.2% in January. In comparison, the index was 74.1% one year ago and 65.1% five years ago. For first home buyers, Roost reported figures for February showing 84.7% of one median income to service the mortgage on a lower-quartile priced house for a person in the 25-29 age group, up from 82.2% in January and 77.5% one year ago.

- New Zealand has continued to experience strong net migration inflows, with an average net migration inflow of over 3,000 persons per month between November 2013 and February 2014. Migration flows were especially strong at the start of the year, with the net migration figure for February reaching 3,500 persons, the highest monthly inflow in over ten years. Overall, New Zealand recorded a net migration inflow of over 25,000 for the year ended January, which was the highest yearly inflow over the past decade. Although Australia continues to dominate the top of the list of locations to which Kiwis permanently emigrate to, the net loss of 17,100 in the January 2014 year is well down from the net loss of 37,900 in the January 2013 year. The change in net loss was the result of a decrease in departures to and an increase in arrivals from Australia, which points to increased confidence in the New Zealand economy.

- The volume of residential building activity continue to exhibit strong growth, increasing by approximately 9% over the second half of 2013, driven by strong building activity in Canterbury. Building consent issuance have also increased, with the number of consents issued in February 2014 being the highest number of consents issued since December 2007. The large numbers of consents recently issued will provide a strong foundation for residential building activity over the short to medium term.

- Consumer confidence in New Zealand has continued to surge throughout the end of 2013 and the beginning of 2014, with the country’s economy being firmly in recovery mode. Although the new lending restrictions had put dents in consumer confidence shortly after its introduction, the space in the market vacated by first-home buyers has created opportunities for investors. In terms of the effect of the new lending restriction, overseas evidence from similar cases indicates the market will adjust after approximately six months or so, which suggests any impact on the market will be limited unless there are fundamental changes to demand and supply dynamics. Nevertheless, the overwhelming sentiment in the market points to high house price expectations over the next two years.