Housing – and the cost of it – is one of New Zealand’s hottest political issues. Despite the hyperbole, the fundamentals are sound and it remains one of the best long-term investments according to Alan Henderson, Director of property investment experts Erskine + Owen. As a property investment expert, as well as an experienced residential…

Read MoreAuckland home prices are up more than 20 per cent in the past year. If you’re a buyer from China or the US, they’re not. The slump in New Zealand’s currency has made properties in the country’s largest city a bargain for foreigners, creating a headache for central bank Governor Graeme Wheeler, who has been…

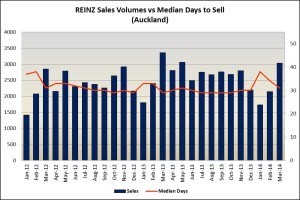

Read MoreDespite what we might have called “pre-election jitters” dampening the market a tad, the housing market rebounded in October, and is lining up for a strong finish to the year. Increased mortgage lending that is recovering from 2 year lows, cuts to fixed mortgage rates, and net migration at record highs all provide strong support.…

Read MoreIn March, the BNZ-REINZ residential market survey of real estate sales agents reveals an ease in market sentiment, as agents around the country reported most regions to be in equilibrium as buyers began to tentatively re-enter the market after adjusting to last year’s change in lending rules. However, anecdotal evidence from the survey is suggesting…

Read More

Interview with Tony Alexander, BNZ Chief Economist

Podcasts from The Property Pod – Expert insight into New Zealand’s property market Brought to you by Erskine + Owen and Point Property Management In this wide ranging interview we hear from Tony about his personal journey to becoming BNZ Chief Economist, and of course in true Tony style – his thoughts on the economy and…

Read More