The Inflation Genie is Back in the Bottle…

The Inflation Genie is Back in the Bottle… What are we Waiting for?

When there is ‘an elephant in the room’ that needs to be addressed, how do you deal with it?

Let the air from the beat of your wings waft over people and make them think….i.e. approach with incredible diplomacy? Shoot the elephant with your blunderbuss…confront the issue head on? Or hang a sheet over the elephant, and sweep the issue under the carpet?

I think inflation has been taken to in NZ with a blunderbuss…as it has in most countries. The question is, if you keep shooting for longer than you need to, will there end up being collateral damage?

The Inflation Blunderbuss

It was Mark Twain that said “lies, damn lies and statistics”. We are told inflation is now at 4% per annum. But how is that calculated, and are we being mislead?

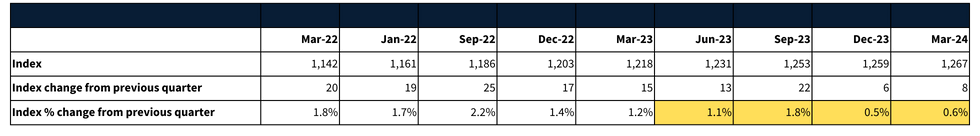

Firstly, let’s understand the calculation. CPI is the consumer price index. It is a collection of the prices for a range of goods and services. A weighting is then applied, and then the index number is calculated. So, for example, in the December 2023 quarter it was 1,259, and in the March 2024 quarter it was 1,267.

That’s the index side of it. Department of Stats then calculates inflation by calculating the percentage change in this number…compared to the same quarter 12 months prior. For example:

- In March 2024 the CPI was at 1,267.

- In March 2023 it was 1,218.

- The difference in these two number is 49.

- As a percentage of 1,218 this is 4%.

- So, inflation as at March 2024 is running at 4%

Where this approach starts to get a bit misleading, in my opinion, is if the index doesn’t grow next quarter. That is, if it remains at 1,267, to my mind that means that inflation has eased. However, because we are comparing this number to 12 months prior it is telling us we still have CPI growth…i.e. inflation…of 2.9%. See table below. Now it is true to say that prices are higher than 12 months ago…but does that mean we still have inflation? Come in Mark Twain.

(Source – Stats NZ)

The Department of Statistics will argue that it is dangerous to rely on measuring the difference between two consecutive quarters to tell us what inflation is doing.

Fair enough, but what if:

- We take the change in the index from the previous quarter and multiply by 4 to get an annualised inflation rate. The March index number of 1,267 was 0.6% greater than the December quarter (see table below). If we annualise that number by multiplying by 4, we get inflation of 2.4%.

- Or we add the change of the last two quarters 0.5% and 0.6% = 1.1%, then annualise by multiplying by 2 to get inflation of 2.2%.

- Or… we could add the changes of the most recent 4 quarters and we get 4%.

- Or… we could take an average of all the approaches.

(Source – Stats NZ)

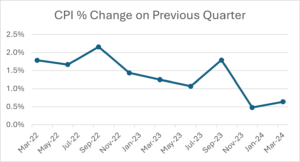

The point of this is to show that if we look at the previous quarters as an indicator of where we are going, we can get a different number than comparing to the prior year. We have graphed the change in CPI quarter-on-quarter below. September looks to be an anomaly; we have been trending downwards and it may be that we have reached an equilibrium of about 0.55% growth in the index per quarter… which would put us at 2.2% inflation if we annualised this number.

My point is, that just comparing to the prior year can be misleading. I think we should be looking at a variety of calculations. Why? Because continuing to report in this way, in my opinion, could lead to us keeping the OCR higher for longer than it needs to be.

(Source – Stats NZ)

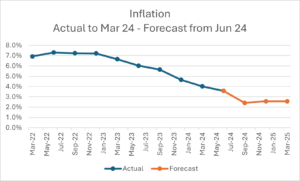

However, I have no sway over how the Department of Stats calculates inflation. So, when will inflation be back under the 3% threshold using the Department of Stats approach?

Well..if we use that March 2024 quarter-on-quarter % change of 0.6%, as above, to forecast CPI – the graph below shows that we’ll be back in ‘the zone’ by September 2024. And we’ll stay there if we stay at this rate of change…quarter-on-quarter.

How sensitive is this calculation? If the % change is 0.7% per quarter we’ll still be in the zone – but if it is 0.8% we’ll be a smidgen above the Inflation target rate (as measured by RBNZ) of 3%. If its 0.5% per quarter then it looks like we’ll sit at an inflation rate of 2%.

(Source – Stats NZ)

To summarise

- If we keep tracking the way we are, inflation will be under 3% (as calculated by Department of Stats) by September 2024.

- If the CPI does not increase to June 24, we will still have inflation of 2.9% – because the Department of Stats looks at the change in the index from 12 months ago.

- The growth in the index in the last two quarters has slowed dramatically. At this rate of change (average 0.55% per quarter) we are already well under 3% annual inflation (if we annualise the 0.55%).

- We think the RBNZ should be looking at the CPI in a few different ways so that they don’t risk keeping the OCR where it is for longer than it needs to be.

Keep Blundering on

The RBNZ has just announced that the OCR will remain unchanged. The latest inflation driver culprits are insurance, council rates and residential rents. Right…so the rhetoric a year ago was that Kiwis needed to have a good hard look at themselves and stop spending like there was no tomorrow…or at least that is what it felt like. Now we are being told that inflation is not tamed because of costs no consumer has much control over. Really? Aren’t the insurance premium hikes a consequence of floods? And what can consumers do about rates? And rents – the RBNZ is concerned that higher interest rates has not had the dampening impact on rent rises they had hoped for…no kidding – if the population grows, but the housing supply doesn’t, then that means demand exceeds supply, and supply won’t change until investors can get finance and can buy more property, so that builders can build…and people can’t get finance while the bank test rate for serviceability is at 8.9%.

I think we did land on the moon, I think the world is round, I think the earth revolves around the sun, and I think any suggestion that inflation has not yet been fully dealt to is the result of sniffing genie fumes and becoming conspiratorial. Time to put away the blunderbuss?

So What?

OK, so thanks for letting me vent my frustration. I am not as smart as the RBNZ Governor or the board and I can’t influence the OCR or the big banks. I need to respond to the hand dealt in front of me which is an RBNZ attachment to a 5.5% OCR and the consequences of it. What should we do now?

Let’s assume that the OCR won’t drop this year and that I will lose my bet it would. That means

- There will be people out there getting mentally and emotionally exhausted.

- Some people will choose to sell just to rid themselves of undue stress. They will decide that taking a chunky discount on their expected sale price is worth it for the stress it saves them.

- Potential purchasers buoyed by the prospect of dropping interest rates, will have had the wind taken out of their sails by the prospect of rate drops being postponed till next year.

What will we do?

- Remain steadfast in our belief that the tide has to turn… and sometime soon, because the constraints of higher interest rates on the property market, cannot last.

- Know that we could see some good buying as a result of the “deflated purchasers and stressed out sellers”

- Know that the added interest cost that hits our pocket will be more than redeemed by the great deals we pick up at this time of the market.

- Act – go and find a great deal, and buy it.

What will you do? Will you wallow in your deflation and stress, or choose to see opportunity and seize it? If you are someone that wants to act then please talk to us…we can help you make it happen.