Property Market Update: “Farewell, we expect you’ll go well son…”

Property Market Update: “Farewell, we expect you’ll go well son…”

Our eldest departed for university a couple of weeks ago. I expect he’ll go well. He’s quite academic, sporty and determined (maternal traits). We gave him a credit card for emergencies which has already come in handy on several occasions – once at the Marlborough Pub and twice at the Salisbury Bar (paternal traits – taking on debt, that is). While we expect he’ll go well, we also expect the odd ‘emergency’.

Expectations are important because they guide thinking and actions. Back at Christmas 2022, we said that the back of inflation had been broken, and while there would be drama, the inflation fighting work had been done. Isn’t that pretty much what happened? A year later, in November 2023, our Three Musketeers market commentary predicted that our new government, who are more favorable to investors, would result in people finishing the holiday season feeling refreshed and more confident to crack-on with buying properties. Prices would start to rise as a result. At Erskine Owen, we are certainly seeing demand increase.

So, what’s my point? We expect inflation to slowly recede, interest rates to drop and property prices to rise. Along the way, we expect and plan for a few bumps, but we don’t expect the bumps to derail the train. What specifically are our expectations?

- Net migration continues at breakneck speed: 2023 net migration was 126,000 – translating to annual population growth of just under 3%, against the long-term average of 1.2%. This net migration equates to needing, on average, 60,000 more homes (accounting for deteriorating stock as well).

- Housing supply is not keeping up: Consent levels are only a third of the net migration number! So we are well short.

- Return of interest rate deductibility on residential investment properties and reducing the bright line test back to two years will bring more investors into the market.

- All this suggests prices must surely go up. The restraints of finance need to loosen, but when they do (and we believe they have to), then prices will accelerate upwards.

Recently one or two big banks have predicted more interest rate hikes, due to stubborn inflation.

Here’s how I approach this:

1. Expect the unexpected: Swimming legend Michael Phelps, the most decorated Olympic athlete in history, always prepared for the unexpected. He practiced with faulty goggles, just to be prepared. In the 2008 Olympics, his goggles filled with water and he struggled to see. But he knew how many strokes each length was, and he won gold. A confession: In 2019, while I wouldn’t have said interest rates would never rise beyond 5% again, I certainly never thought they’d race up like they did. I simply didn’t anticipate it.

So, what is the unexpected event that could happen in the housing market?

- Interest rates could sit where they are if the RBNZ thinks inflation needs a continual flogging. They could be stubborn and not fall for another two years. What are your plans for that scenario?

- Interest rates could drop quicker than anyone thought. If that happened there would be a buying frenzy. Currently, people think they have forever to buy at these prices. It won’t last. Are you holding all the property you want? How would you feel if you see property prices go up 20% in one year and you are scrambling to secure your planned purchase?

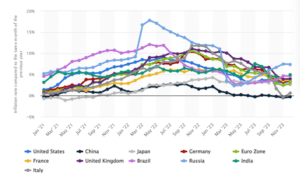

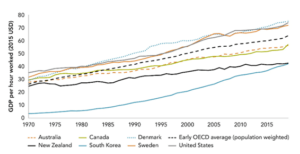

2. Stop only reading the Herald: I read the Australian Financial Review and focus on what global economists say. I want to understand what is going on in the big economies outside little old New Zealand, because, what happens on the world stage affects us. It’s dangerous for us to focus too much on what the ‘locals’ say. The Statista inflation graph below tells a pretty clear story – that on the global front, inflation is being tamed. So, can we relax? We know New Zealand has small country challenges (e.g. our labour productivity rate isn’t great comparatively – see Productivity Commission Graph below). This might make it harder to drive down inflation, and highlight the need to attract talent and IP to this country. But, does that mean inflation and thus interest rates won’t drop? Surely the global trend of downwards inflation will trickle through to NZ…at least in part?

My response to this is, don’t get thrown from pillar to post by sensational headlines.

Statista: Inflation Trends

Productivity Commission: Labour Productivity Comparisons

3. Stay focused on the gold medal. Do you think Phelps spent 90% of his time fretting about broken goggles? While he certainly prepared for the unexpected, it’s hard to imagine he spent entire sessions every week in broken goggles. He was far too busy focusing on his technique and imagining winning. The same applies to property investing. Don’t let sensational headlines about inflation distract you from your investment goal. You do have a goal, don’t you? If not, come and see me for a property investment planning session. If your goal is to hold $10m of investment property and you are at $5m – is fretting about what the bank says interest rates will do helping you towards your goal? Be brave and get on with buying the next property in a way that you can afford at current interest rates, allowing for a slight increase. Instead of worrying what the banks say, look at what history suggests property prices will do.

I guarantee that in a couple of years time, there will be people that will say to me ”Ohhhh, I should’ve invested in that 8% yielding syndicate you told me about ….that was a really good one, wasn’t it?” And, I’ll say: ”Yes it was, Baldrick. But don’t be sad and don’t look back. Get investing.”

Please don’t be a Baldrick.

Don’t forget:

- New Zealand’s population growth for the year to November 23: 127,400. If the average number of people per household is 2.7, that means we need 47,185 new dwellings.

- For the year to January 2024, 36,000 houses were built. Remember, you can’t live in a consent! And not all consents turn into a house.

Back to my son. I expect he will go well in his new chapter at university, but I am prepared for some emergencies. We’ll get through, because we have our eye on the prize of him having a great time and getting a good education, and a job at the end.

We are expecting property prices to start going up this year. There could be some bumps, but we have our eye on the prize. Where is your focus?