Offer Summary

This offer is fully subscribed

+ 8.0%* projected cash return paid monthly

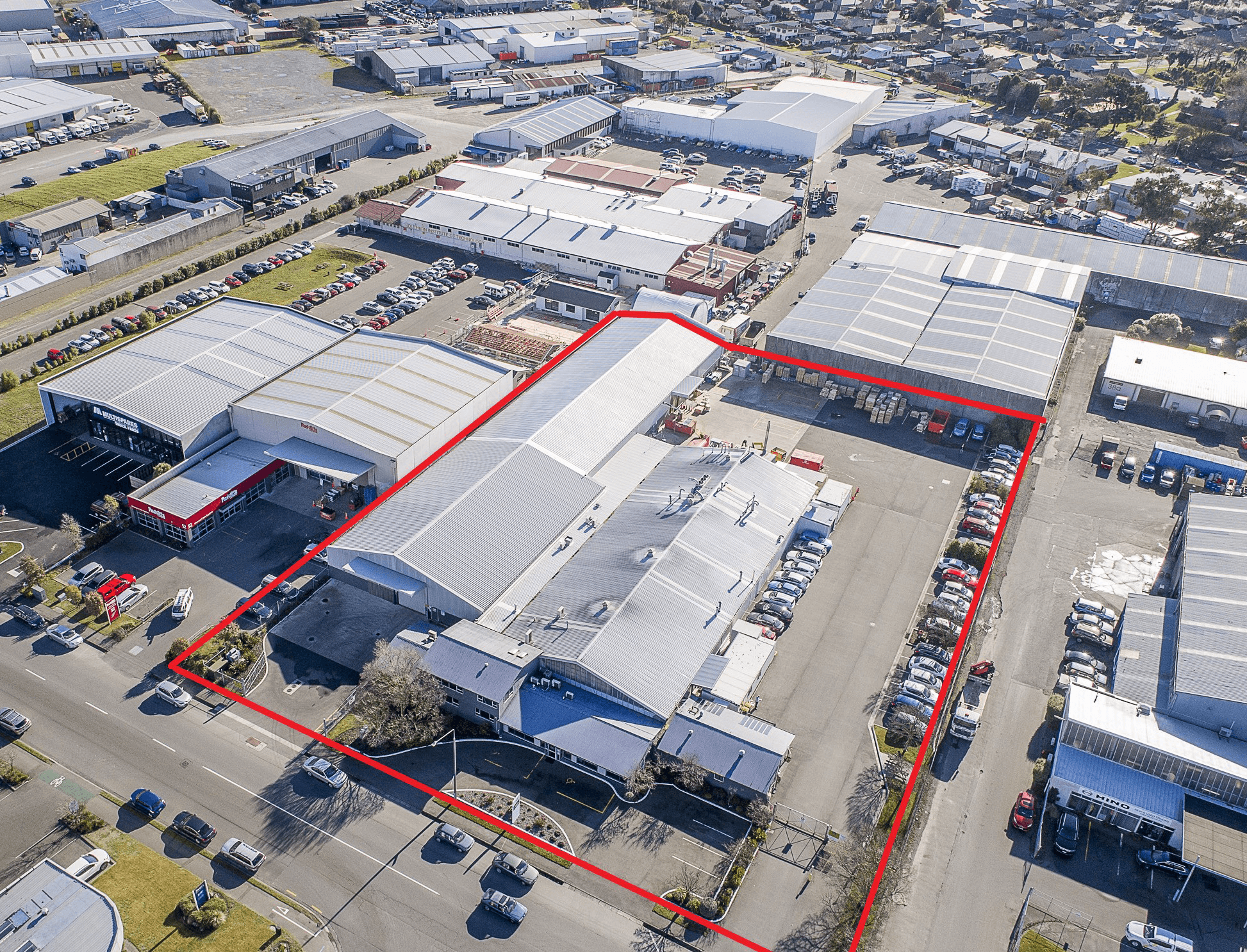

+ Premium industrial location in Christchurch, close to CBD, Airport & SH1.

+ Longstanding tenant with ‘essential services’ client base.

+ $100,000 minimum investment for wholesale/eligible investors

*Projected pre-tax return for full one year period. Details on how the return will be calculated, and the risk associated with the investment and return, are set out in the Information Memorandum

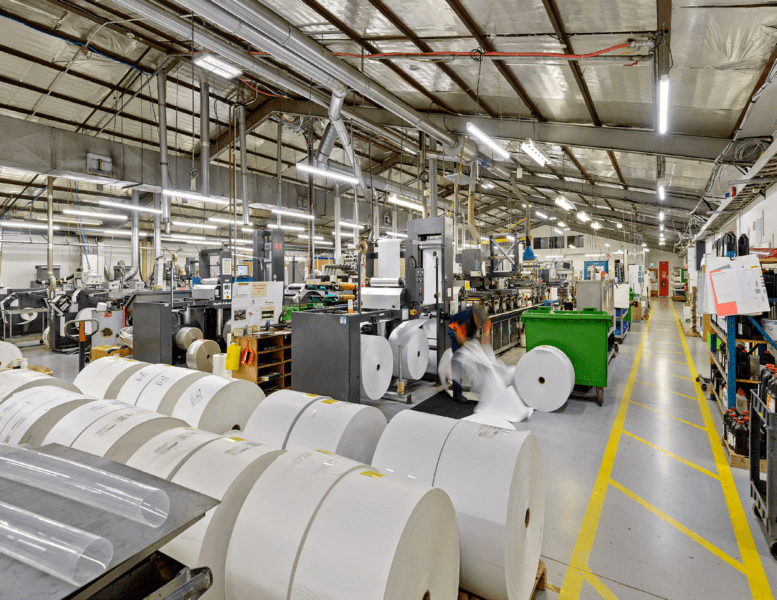

The Tenant - Hally Labels

Founded 55 years ago, Hally Labels is a leading trans-Tasman label manufacturer with productionfacilities in Auckland, Brisbane, Sydney and Christchurch. The business has built a strong reputation in the Australasian packaging sector, with its labels featuring on a number of prominent household brands – including many food and beverage products.

The value of this client portfolio became evident during the recent pandemic shutdown, when Hally’s food processing clients were classified as essential service providers, Hally was able to trade successfully and maintain operations during a time of unprecedented economic stress.

The company has a substantial footprint with 200 staff and 26 label presses across their four sites.

Source: www.hallylabels.com/about

The Location

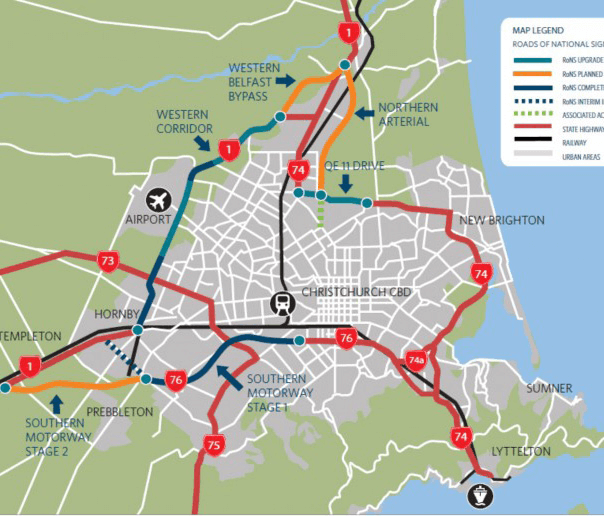

With its nearby port, international air links and growing population, Christchurch provides a strategic base for businesses serving the South Island domestic and export markets. Substantially rebuilt over the last decade, the metro area serves a population of just under 400,000.

The property is conveniently located in Hornby, approximately 12km southwest of the CBD and just 8km from the airport. With its mix of business parks and purpose-built industrial sites, Hornby provides a business-friendly base for companies looking to take advantage of the area’s excellent transport infrastructure.

State Highway 1 runs through the suburb, and the second extension of the Southern Motorway and Shands Road interchange (currently under development) will further boost development in the area. Rapid access to the Christchurch CBD and easy access to the south will likely prove a winning combination for a wide range of businesses.

Christchurch industrial vacancies have tightened recently as investor interest in prime stock has remained strong*. While yields will continue to vary over time and between properties, we believe Hornby is well placed to benefit from ongoing investor demand.

Risks

Investments in syndicated commercial and industrial property does carry risk. Prospective investors must determine whether the investment is appropriate having regard to their own investment objectives and financial situation. Investors are encouraged to seek independent financial, tax and legal advice on these matters.

The Offeror and General Partner considers that the most significant risk factors that could affect the value of a Limited Partnership interest are:

+ Loss of rental income: A default by any tenant in paying rent and outgoings may affect forecast returns.

+ Re-leasing: Costs may be incurred in any future re-leasing of the property and failure to re-lease will likely affect its value.

+ Interest rate and bank risk: Interest rate movements are unable to be accurately predicted and an increase in interest rates may affect returns and bank covenant compliance.

+ Capital expenditure risk: Capital expenditure for the property may be more than budgeted.

No warranty or representation is made in respect of whether the revenue, expenses, or any capital appreciation in the future will be achieved. Actual results are likely to be different to the forecasts since anticipated events frequently do not occur as expected and the variation may be significant. Accordingly, Erskine + Owen, its shareholders, directors, employees, advisors or agents nor any other person can provide any assurance with respect to such information.