Offers will be restricted to “Wholesale Investors” under clauses 3(2) and 3(3) of Schedule 1 to the Financial Markets Conduct Act 2013 (or to any other person to whom an exclusion applies under Schedule 1 of that Act). Preliminary indications of interest are being sought at this stage and no indication of interest will involve an obligation or a commitment to participate in the Offer.

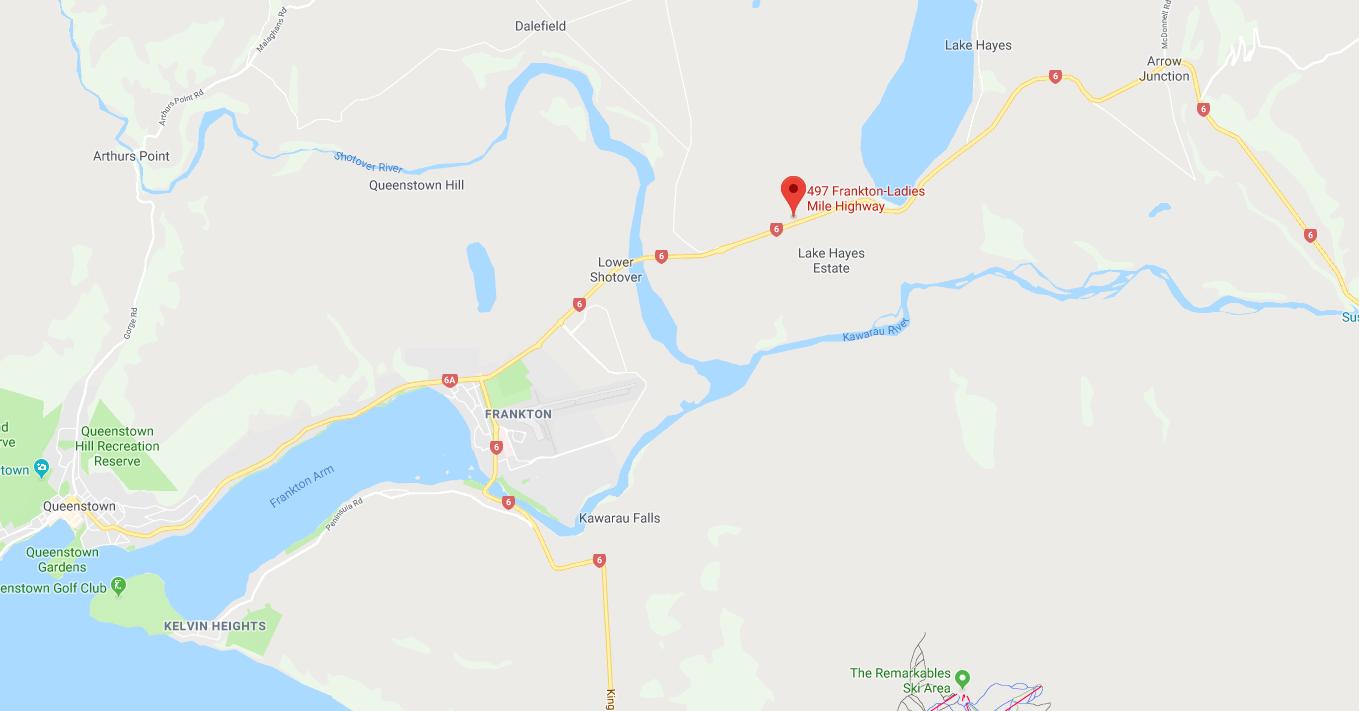

Queenstown

Queenstown is one of the fastest growing regions in the country with the residential population expected to almost double in next 40 years!

Projected population growth indicates long-term demand for residential, commercial, and industrial properties to support the unprecedented growth in the tourism sector.

Queenstowns visitors in peak season out-number residents! Hotel and motel occupancy rates re-main at historic highs, more visitor beds are needed, with accommodation reaching full capacity in peak seasons – which now includes both the winter and summer months.

Residential property in Queenstown is in high demand. The median house price for residential property has jumped substantially in only 5 years, and all indicators driving property (tourism, economic growth, low interest rates, population growth, infrastructure development, investor confidence), suggest the growth looks set to continue for quite some time. Housing is also in limited supply in the region. The local council predicts a need for an additional 17,426 house by 2048.

Risks

Investments in syndicated commercial and industrial property does carry risk. Prospective investors must determine whether the investment is appropriate having regard to their own investment objectives and financial situation. Investors are encouraged to seek independent financial, tax and legal advice on these matters.

The Offeror and General Partner considers that the most significant risk factors that could affect the value of a Limited Partnership interest are:

+ Loss of rental income: A default by any tenant in paying rent and outgoings may affect forecast returns.

+ Re-leasing: Costs may be incurred in any future re-leasing of the property and failure to re-lease will likely affect its value.

+ Interest rate and bank risk: Interest rate movements are unable to be accurately predicted and an increase in interest rates may affect returns and bank covenant compliance.

+ Capital expenditure risk: Capital expenditure for the property may be more than budgeted.

No warranty or representation is made in respect of whether the revenue, expenses, or any capital appreciation in the future will be achieved. Actual results are likely to be different to the forecasts since anticipated events frequently do not occur as expected and the variation may be significant. Accordingly, Erskine + Owen, its shareholders, directors, employees, advisors or agents nor any other person can provide any assurance with respect to such information.